- Shop Now PAY LATER -

What is Affirm?

Affirm is a financing alternative to credit cards plus other credit-payments. Affirm offers instant financing for buying online paying in fixed monthly installments.

Why buy with Affirm?

Buy and receive your purchase right away, and pay for it over several months. The payment option allows your purchase into fixed payment amounts that fit your monthly budget.

How does Affirm work?

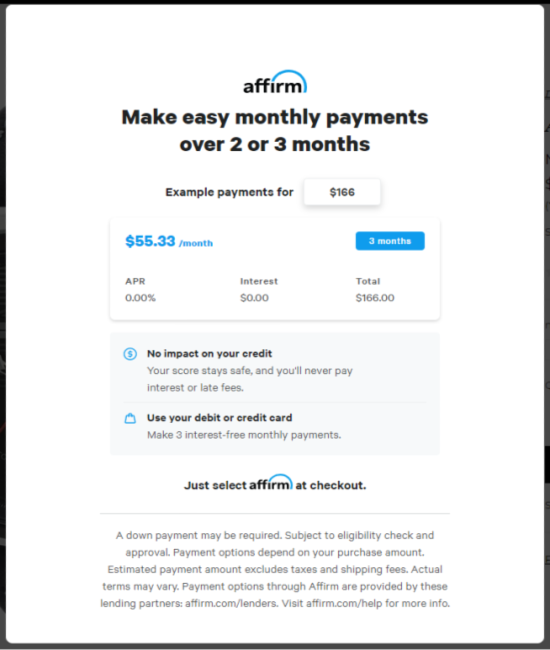

When you go to checkout, choose Pay with Affirm. Affirm notifies you of the loan amount you’re approved for, the interest rate, and the number of months you have to pay off your loan. Payment terms depend on your purchase amount and can range from two to thirty-six months.

Does Affirm do a credit check?

Affirm does a credit check which verifies the customer’s identity but does not affect a customer’s credit score. There is no effect on a consumer’s credit score when they apply for an Affirm loan.

Why was I denied financing by Affirm?

The merchant has no information regarding a customer’s financing denial. Affirm strives to offer all credit-worthy applicants financing with Affirm, but isn’t able to offer credit in every case. Affirm will send you an email with more details about its decision. Unfortunately Affirm’s decision is final.

What are Affirm’s fees?

The annual percentage rate (APR) on an Affirm loan ranges from 0% to 30%. Affirm discloses any required fees upfront before you make a purchase, so you know exactly what you will pay for your financing. Affirm does not charge any hidden fees, including annual fees.

How do I make my payments?

Before each payment is due, Affirm sends you an email or SMS reminder with the installment amount that is coming due and the due date. Go to www.affirm.com/account. Once signed in you can click the loan payment you would like to make.